What Do You See?

Spend enough time talking to real estate investors and you’ll find they generally fall into two groups. Those that prefer core, stabilized, slow-and steady investments, and others looking for more action in non-core strategies like development or buy-fix-sell.

The core investors are content to get rich slowly while sleeping well at night as the market does the heavy lifting. Their 401(k)s and stock portfolios are probably full of simple index funds. They accept that the market will be up and down, but taking on development risk, and all the associated challenges, goes in the “too hard” pile.

The non-core investor loves to build, to drive value appreciation, and move on to the next project. Their public market counterparts are stock pickers or venture capital investors. Core is boring, the inevitable challenges that come with any development or rehab project are energizing, and the upside that can be earned in solving them is well worth the trouble.

Ironically, both groups are dependent on each other. Without developers taking risks to put up new buildings, there would be nothing for the core investors to buy. And without core buyers, the developers would have no way to exit completed projects and move on to the next.

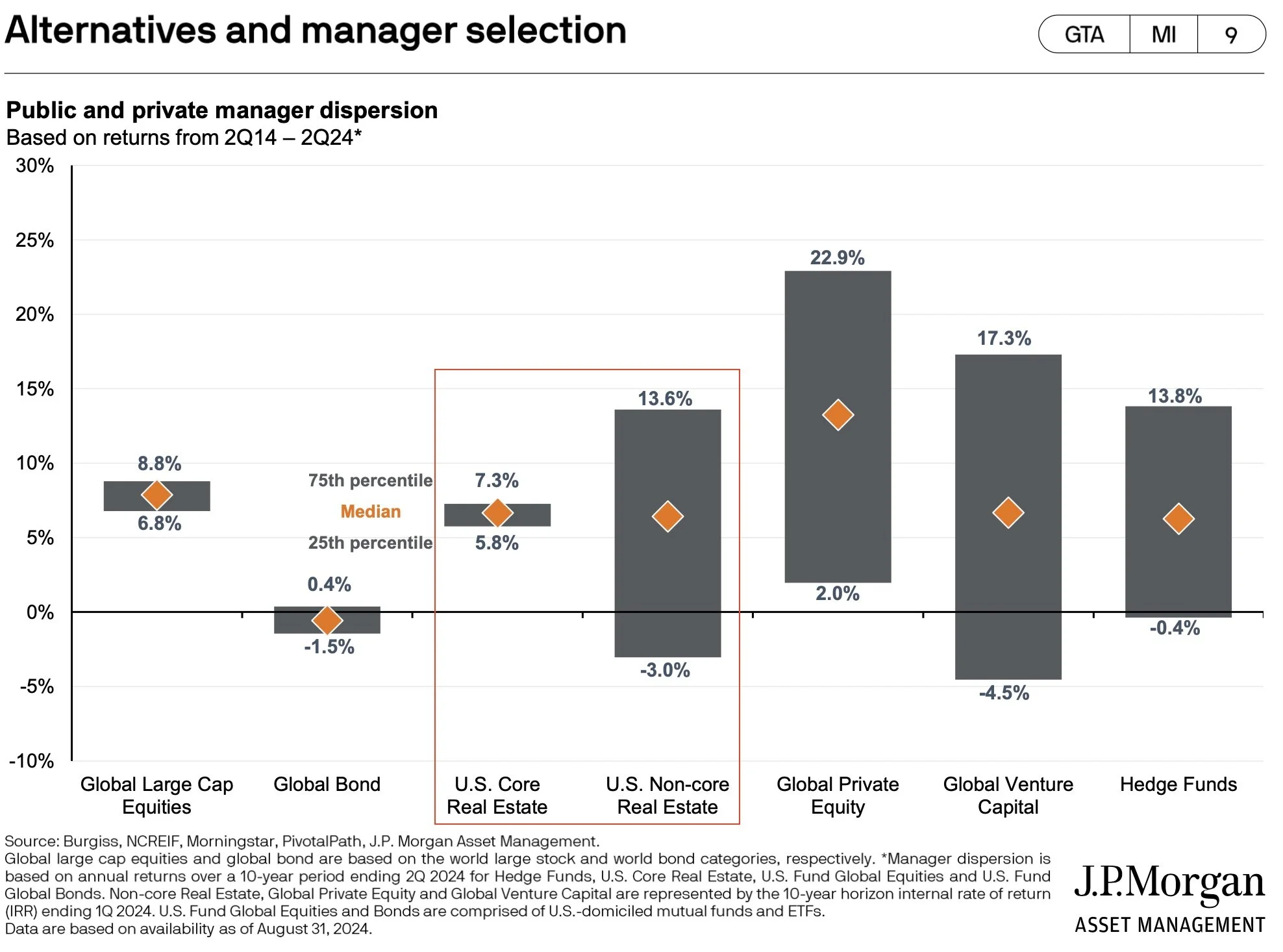

Which strategy is better? Neither is right or wrong. The question each investor needs to ask themselves is which strategy is right for me? My favorite chart on the subject, courtesy of JP Morgan’s Guide to Alternatives, does a great job of illustrating the tradeoffs between the two.

Source: J.P. Morgan Asset Management

Over 10 years, the median return for both strategies is essentially the same. So the Rorschach Test for any investor is: what do you see when you look at the two bars side to side? The non-core investor’s eye jumps to the high return of 13.6%, either ignoring or accepting the -3.0% as a (hopefully) unlikely outcome that can be avoided with skilled manager selection.

The core investor sees an average return that is right in line with the non-core strategy, with a much narrower range of outcomes. Why bother trying to pick the best managers when doing so consistently over time is nearly impossible? They are willing to give up the potential for significant upside to reduce the likelihood of significant downside.

For those that see the benefits of both sides, the happy medium may be a barbell strategy. A primary portfolio of core properties, quietly compounding their way to long-term growth, combined with the occasional, high-conviction opportunistic investment. Like complementing simple index funds with a small play-money portfolio or crypto account, the barbell provides a stable base and allows for some fun along the way.

The bottom line? Know yourself, and invest accordingly.